10 April 2025

Employer of Record vs. subsidiary in Spain: which is the right choice for your business?

Expanding into Spain offers international businesses a gateway to one of Europe’s most vibrant markets. Known for its strategic location and skilled workforce, Spain presents many opportunities for companies looking to grow their global presence. However, choosing the right entry strategy is critical to ensuring success.

Two common approaches are setting up a local subsidiary or partnering with an Employer of Record (EOR). Both options provide pathways to hiring employees, maintaining compliance, and establishing a foothold in Spain, but they differ significantly in terms of cost, complexity, and flexibility.

This article explores the key differences between an Employer of Record and a subsidiary in Spain. By understanding the pros and cons of each approach, you’ll be better equipped to decide which option best aligns with your business goals, timeline, and risk tolerance.

What is an Employer of Record (EOR) in Spain?

An Employer of Record is a service provider that enables international companies to hire employees in Spain without establishing a local legal entity. Essentially, the EOR becomes the legal employer of your team in Spain, handling all employment-related tasks—such as payroll, contracts, tax withholdings, and social security contributions—on your behalf. Meanwhile, your company retains full operational control over these employees’ day-to-day activities.

This arrangement is ideal for businesses that want to test the Spanish market, hire quickly, or expand with minimal upfront investment. By partnering with an EOR, you gain a compliant hiring solution that lets you focus on your core business objectives rather than learning Spain’s complex legal and administrative processes.

What is a subsidiary in Spain?

A subsidiary is a local, incorporated entity established under Spanish law. Unlike an EOR, a subsidiary requires formal registration with Spain’s Registro Mercantil (Commercial Registry) and Agencia Tributaria (Tax Agency).

This process involves choosing a legal structure—such as a Sociedad Limitada (SL) or Sociedad Anónima (SA)—and fulfilling various administrative steps, including depositing share capital, appointing legal representatives, and maintaining a Spanish bank account.

Establishing a subsidiary is a more permanent and resource-intensive commitment. It’s typically the preferred route for companies that intend to make long-term investments, build significant operations, or maintain full control over employment and business activities in Spain.

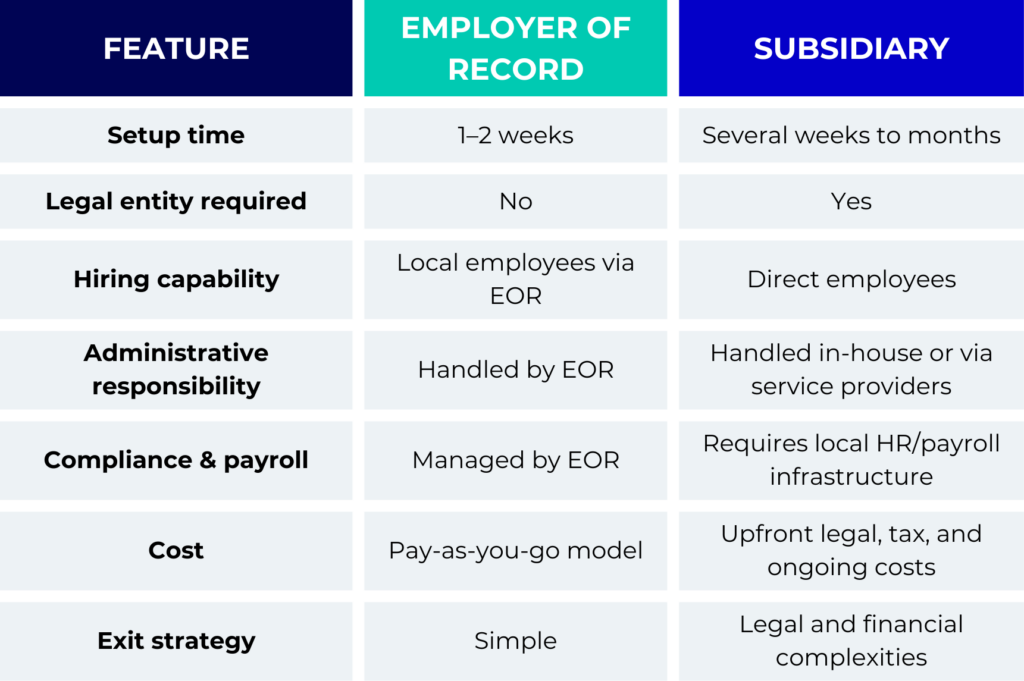

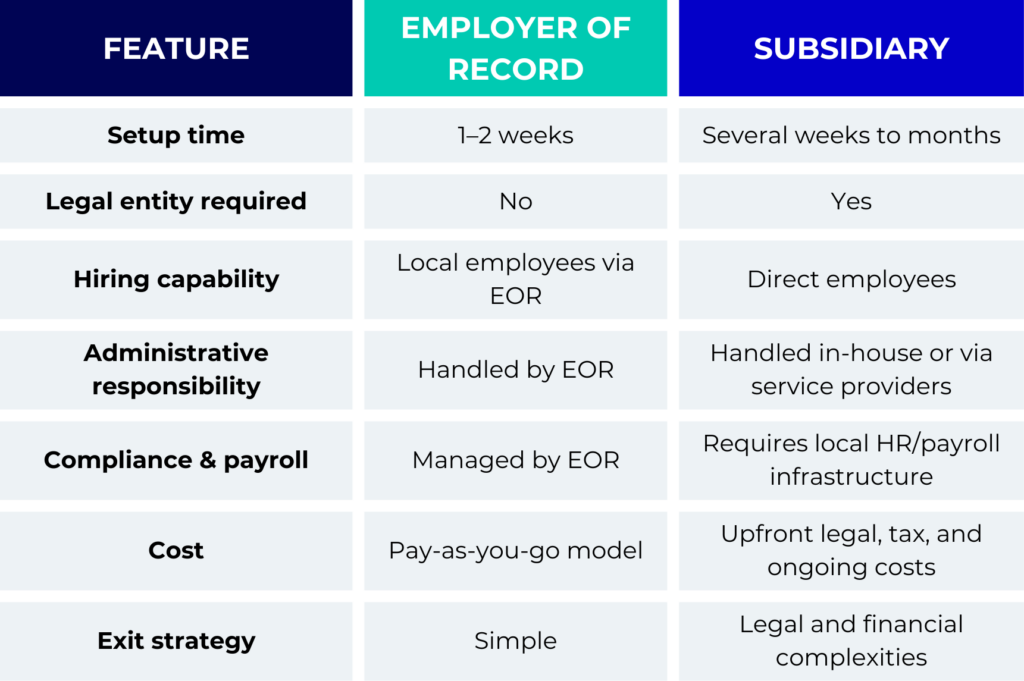

Key differences: EOR vs. subsidiary

Below is a comparison of the main features of an EOR and a subsidiary:

Each option offers distinct benefits and challenges, making it important for businesses to carefully consider their long-term goals, compliance requirements, and the complexity of their market entry strategy.

Legal, tax, and compliance implications

When considering expansion into Spain, understanding the legal and tax obligations associated with each approach is critical:

Subsidiary

Setting up a subsidiary in Spain means your company is subject to Spanish corporate tax, must comply with full financial reporting requirements, and may face greater liability exposure. While this structure allows for more control, it also comes with increased administrative overhead and ongoing compliance responsibilities.

Employer of Record (EOR)

An EOR eliminates the need to establish a legal entity, reducing the risk of permanent establishment if appropriately structured. The EOR ensures compliance with Spanish labour laws, manages payroll and tax filings, and provides a streamlined solution for hiring employees. This significantly lowers the compliance burden on your in-house team, making it a more agile and cost-effective option for many businesses.

Companies that rely on freelancers or informal hiring arrangements may inadvertently fall afoul of Spanish employment laws. Misclassification of workers can result in fines, back taxes, and reputational damage. The EOR and subsidiary models offer compliant alternatives, ensuring all employees are correctly classified and legally employed.

When should you choose an Employer of Record in Spain?

An Employer of Record in Spain is often the ideal choice in several scenarios, including:

- Testing the market: If you’re entering Spain for the first time and want to gauge market potential without committing to a full legal entity, an EOR provides a flexible solution.

- Hiring quickly: An EOR can help you onboard employees within weeks, compared to the months it may take to establish a subsidiary.

- Avoiding permanent establishment risk: By leveraging an EOR, you can mitigate the tax and compliance risks associated with setting up a local office.

- Maintaining a lean operation: An EOR allows you to focus on your core business activities while the provider handles employment contracts, payroll, benefits administration, and compliance.

For example, John, a Canadian entrepreneur with a successful IT marketing firm, expanded his operations into Europe. With its thriving tech scene and talented workforce, Barcelona seemed like the perfect base. However, John quickly realised that establishing a legal entity in Spain, understanding local labour laws, and managing payroll compliance could be a lengthy and costly process. Instead of delaying his expansion, he partnered with an Employer of Record.

The EOR took care of hiring local talent, ensuring all contracts, taxes, and social security contributions complied with Spanish regulations. Thanks to this arrangement, John was able to scale his business in Barcelona without the burden of setting up a legal entity, allowing him to focus on growth and innovation.

How does an EOR support your expansion?

- Employment contracts: The EOR ensures that all employment agreements are compliant with Spanish labour laws and tailored to local regulations.

- Onboarding and benefits administration: Your employees receive the same level of care as if they were directly employed by a local entity, including access to benefits like health insurance, retirement contributions, and paid leave.

- Payroll and compliance: The EOR takes on the responsibility of processing payroll, calculating taxes, and filing all necessary reports.

Risk mitigation: With an EOR, you reduce the legal and financial risks of hiring abroad, giving you peace of mind as you grow your international team.

Choose Spanish Employer of Record

When expanding into Spain, choosing between an Employer of Record and a subsidiary depends on your company’s goals, budget, and appetite for administrative complexity. An EOR provides a fast, low-risk option for businesses that need to hire quickly, test the market, or operate with minimal investment. In contrast, a subsidiary offers long-term stability and full operational control, but at the cost of greater time, expense, and administrative overhead.

By carefully considering these factors, your company can select the approach that best aligns with its strategic priorities. If you’re looking for a compliant, cost-effective way to enter the Spanish market, contact us and explore Employer of Record services may be the right first step.